Business Relocation Services

Relocating your business to new territories is key to achieving high efficiency, cost savings and risk reduction

Order a cost estimate and specialist consultation

Types of corporate relocation

- 01Full Relocation. Relocation of the headquarters and/or holding company to a country with a simpler tax and legal system.

- 02Use of intellectual property of holding companies and regional centers. Assumes IP protection and more efficient tax management.

- 03Changing the risk model. If physical relocation is not feasible, the alternative is to operate under a license or commissioner/franchise model.

Benefits of business relocation

- Globalization. Access to capital, goods and markets from many different regions of the world.

- Profit maximization. Reducing the cost of producing products/services will help to maintain a competitive advantage.

- Tax incentives. Governments adjust their tax regimes to incentivize companies to relocate and create jobs.

- Other advantages. Among them: better business conditions, government incentives, corporate responsibility and culture, social stability, ease of attracting investment, etc.

Inversion (complete relocation) of the business

- Suppose a business has the following structure:

- It is possible to create a new holding company in a favorable jurisdiction by exchanging shares between existing companies.

- It is also possible to transfer subsidiaries under a new holding company.

Finding the optimal location for corporate relocation

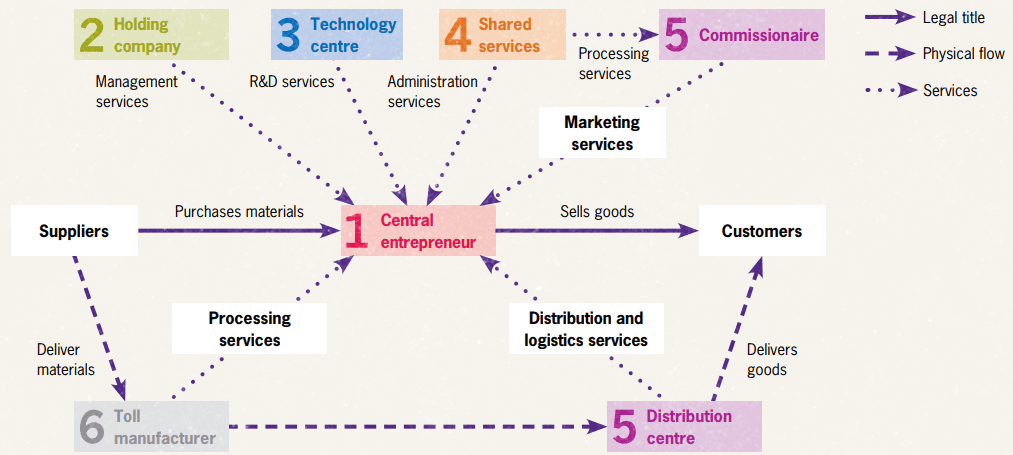

1. The entrepreneur is the center of the structure, and his location plays a key role. Since he is often the holder of the company's intangible assets, choosing the optimal tax treatment for IP significantly increases the effective income tax rate.

2. The location of the holding company is determined by shareholder considerations and the company's bylaws.

3. The technology center is responsible for R&D, and its location is influenced by access to appropriate personnel and possible investment incentives from the government.

4. Common services are often relocated to foreign jurisdictions. For example, call centers are usually located in low-cost countries.

5. If a company has transactions that are difficult to relocate and dependent on the customer's location (e.g., sales and distribution), it may be structured as a commissioner/distributor with limited risk.

6. Contract manufacturing is best located where there is a low-cost base - in Eastern Europe and North Africa.

BCA will help you do business abroad correctly

Calculation of cost of services

Submit your application right now and receive favorable terms of cooperation